The numerous South African SME ecosystem reports that have been published so far in 2018 paint a picture of a rising tide in entrepreneurship: an increasing number of incubators with a diverse range of focus areas, entrepreneurship as an acceptable viable career path, and more money available to fund entrepreneurs then ever in the history of South Africa. So, with all the positive momentum, why does the percentage of successful entrepreneurial ventures not increase exponentially? The ecosystem does clearly more in terms of quantity, but is it delivering the results, the quality, South Africa needs?

Today, South African venture capital firm

Knife Capital announced that it is launching its fourth Grindstone accelerator programme in partnership with African SME market access specialist Thinkroom. Grindstone engineers growth for South African technology entrepreneurs in shaping scale-up companies to become more investable, sustainable and exit-ready.

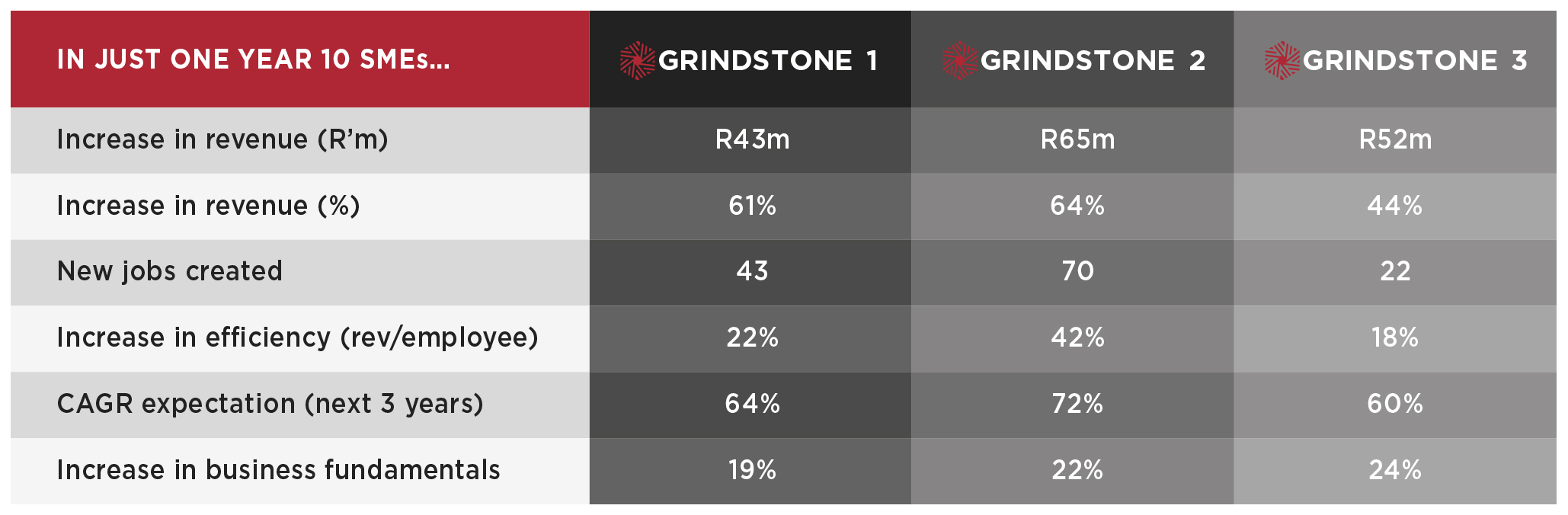

Grindstone is best described as part-accelerator, part-investor and part-advisor and was the first programme of its kind in SA. It does not see itself competing with the numerous other programmes in the market but rather builds on them in a collaborative effort. The year-long Grindstone programme takes ten businesses with proven traction through an intensive review of their strategies and provides them with the necessary support to build a foundation for growth through executive coaching, transfer of skills and introduction to relevant business networks.

“We initially set out to prove that by offering the right guidance and support to coachable entrepreneurs, we can engineer growth on a significant and sustainable scale,” says Andrea Bӧhmert, Partner at Knife Capital. “The fact that so many of our Grindstone companies have experienced growth, investment and/or exits clearly demonstrates that it is possible. The team is excited about taking everything that we’ve learnt into the next Grindstone programme starting in August.”

Some of South Africa’s best scale-up companies have been through Grindstone with measurable results. Knife Capital invested in ticketing solutions provider

Quicket; Tax wizard

TaxTim received strategic investment form MMI, Transport data company

WhereIsMyTransport raised multiple funding rounds from an impressive group of local and international investors, and computer vision & radar startup iKubu exited to Garmin. Top Grindstone growth companies include marketing technology agency

MPULL; financial inclusion business

Picsa; augmented reality animation/ gaming company

SeaMonster; and Bitcoin blockchain specialist

Custos that fights digital piracy. “Grindstone is about measurable growth, about building a foundation that can handle both challenges and opportunities. It is about being prepared as interesting things happen to companies that are ready and able to act on short notice” says Bӧhmert.

Earlier this year, SME market access specialist

Thinkroom Consulting acquired a 50% stake in Grindstone to bring elements of the programme to corporate innovation initiatives and to expand it into Africa. ”We’ve worked with many African startup initiatives through the years and while some add significant value on the funding readiness side, Grindstone stands out as it forces participants to consider themselves as an acquisition target, whilst building and preparing them to be exit-ready. We are delighted to be launching the fourth Grindstone programme with Knife Capital,” says Catherine Young, Thinkroom Founder & CEO.

Knife Capital boasts a significant track record of adding value to high-growth South African technology enabled companies. These include Fundamo which was sold to VISA for $110m; CSense which was acquired by General Electric and the recent exit of orderTalk to Uber Eats. “We created Grindstone by effectively compressing our venture capital engagement model of aggressively growing a company for three to five years into an intense one year programme” says Keet van Zyl, Knife Capital Co-Founder.

The application and selection process will kick off in August 2018 with an interactive Exit Readiness Workshop aimed at providing tangible information to fifty SMEs and unpacking some of Knife Capital’s exit case studies. Twenty companies will then be shortlisted for Grindstone’s early-stage ‘Find-Make-Grow-Realise’ investment course and gap analysis bootcamp, where ten companies will be selected as participants for the final stage of the programme.

Grindstone collaborates with other Incubation and Acceleration programmes to augment the learning experience and continue the growth journey. The programme is supported by Value-adding partners such as FNB Business, Webber Wentzel, Billybo Group, Creative CFO and a range of ex Grindstone companies.

High-growth companies that are interested in joining the Grindstone Accelerator Programme can apply

here