The Minister of Health recently announced that approximately 60-70% of South Africans will become infected with COVID-19, with 20% of those infected being serious cases. With this in mind, there will naturally be a negative impact on the financial position of employers.

With a national state of disaster declared, and potential national state of emergency on the horizon, the outbreak of COVID-19 may result in the temporary (or permanent) shut down of businesses as has occurred in China, Italy and Spain. Employers in South Africa therefore need to proactively consider this possibility in order to contain any negative impact on their businesses.

Employer decision to temporarily shut down business

An employer may wish to temporarily shut down its business for various reasons including -

- an employee(s) contracting COVID-19

- an outbreak of COVID-19 in the workplace

- a regional or national outbreak of COVID-19 (where it is circulating in the community) that causes the employer to fear that health of employees is at risk by continuing with business as usual

- a community outbreak of COVID-19 has a negative impact on business of employer and employer is no longer able to operate

Employers should attempt to reach agreement with its employees and their representatives on how the period of shut down will be managed.

The following measures can be considered -

- temporary lay-off of employees

- reduced pay

- short time

- closure of certain departments/sites only

- remote working

- award special paid leave to employees

- employees to take annual leave

- bring forward any period of annual shut down

- implement unpaid leave for employees

Discussions in an attempt to reach agreement must be carefully managed to adhere to the rule against more than 100 people gathering and social distancing. These discussions could be done by implementing technology like Skype, Microsoft Teams or video conference. Alternatively, employers could use Short Messaging Services (SMS) as a means to obtain agreement with employees. Employees would then need to respond via SMS as well. Non-unionised employees should be encouraged to elect representatives. If an agreement is not forthcoming, employers can implement reasonable and justifiable measures to cover the period of shut down.

Employers must be mindful of section 189 of the LRA which requires that an employer consult potentially affected employees when such employer contemplates dismissal for operational requirements. The obligation to consult employees on possible retrenchment is triggered as soon as the employer “contemplates” dismissal for operational reasons.

The same considerations will apply if the employer elects to permanently shut down the business.

Government-imposed decision to temporarily shut down business

The outbreak of COVID-19 has caused many governments to implement industry-wide shut downs of businesses in order to contain the virus.

This is not a decision taken by the employer but rather by the state. Due to the currently imposed national state of disaster, the state is empowered to take this decision in order to contain COVID-19 and safeguard citizens from infection.

This decision is out of the control of the employer and employee, it is arguable that this amounts to a force majeure or impossibility of performance as it is an unforeseeable circumstance that prevents the employer from fulfilling the contract of employment. The employer may consider applying the no-work-no-pay principle. However, the application of the no-work-no-pay principle should be seen as a measure of last resort. Given the extraordinary circumstances surrounding the lockdown, it is advisable for employers to consider moral and ethical factors in arriving at a decision in the interests of employees and its business.

The same measures as set out above in relation to a temporary closure by the employer should be considered.

Is there any government assistance available to employers during this time?

There are a number of governmental ministers that have announced different types of measures that will be offered to affected employers and employees due to COVID-19. The information currently available on these measures is summarised below.

Unemployment Insurance Fund

Last week, the Minister of Employment & Labour announced that government will come to the assistance of distressed companies within the context of COVID-19. In his statement, the minister said that a period of reprieve will be offered for companies not to contribute to the Unemployment Insurance Fund (UIF). A Temporary Employer/Employee Relief Scheme will be utilised to ensure that employees are not retrenched. The government has not issued any specific details on this scheme as yet.

The

Easy-Aid Guide For Employers for UIF Benefits was published on 20 March 2020. The guide is applicable to employers who are registered with the UIF and make the required monthly contributions. The guide provides information on how the UIF will compensate affected employees and how to apply.

The UIF will assist affected employees through three types of benefits -

-

Reduced Work Time Benefit: This benefit applies when a company shuts down for a period or implements reduced or short time for employees. The exact scope of this benefit is still to be determined.

-

Illness Benefit: This benefit applies where an employee has been quarantined for 14 days. A confirmation letter from the employer and employee must be submitted with the application. We assume that a medical certificate will also be required to qualify for this benefit as this applies for any period beyond 14 days of quarantine. If the employee is quarantined for more than 14 days, a medical certificate must be provided and the benefits may continue. More clarity is required on this benefit.

-

Death Benefit: This benefit applies in the unfortunate event of an employee dying due to COVID-19. Beneficiaries eligible to apply are a spouse, life partner, children and any "nominated persons" (in this order).

The Department of Employment & Labour also envisages that rapid response teams will be sent to assist companies with more than 50 employees to process claims. More clarity is still required on this measure.

Compensation Fund

Last week, the Compensation Commissioner announced that employers will be able register claims with the Compensation Fund if they are related to COVID-19 -

- Section 65(1)(b) of COIDA provides that employees shall be entitled to compensation provided that it is proved that the employee contracted a disease (in this case, COVID-19) that has arisen in the course and scope of his or her employment

- The Minister of Employment & Labour also said in a press briefing this week that

"In line with the provisions of the compensation for occupational injuries and diseases act, if employees contract Covid-19 in the course of performing their duties, they will be compensated."

On 20 March 2020, the Compensation Commissioner published a notice on compensation for occupationally-acquired COVID-19.

Occupationally-acquired COVID-19 is a disease contracted by an employee (as defined under COIDA) arising out of and in the course of his or her employment. This may arise from single or multiple exposure to confirmed case(s) of COVID-19 in the workplace or after official travel to high-risk countries or areas.

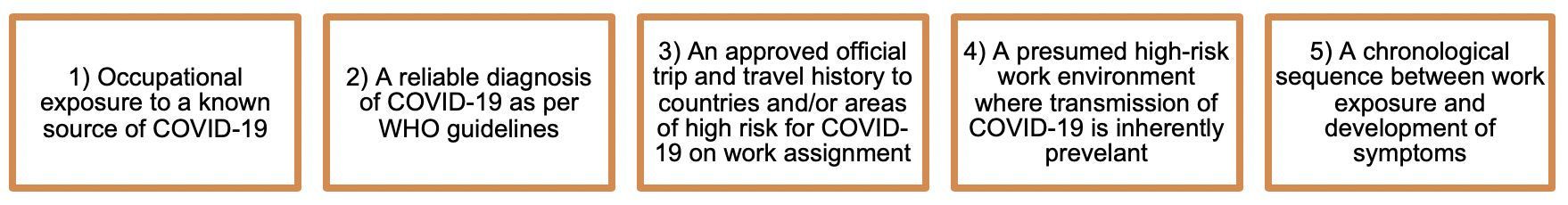

Any claim relies on an occupationally-acquired COVID-19 diagnosis which relies on 5 requirements -

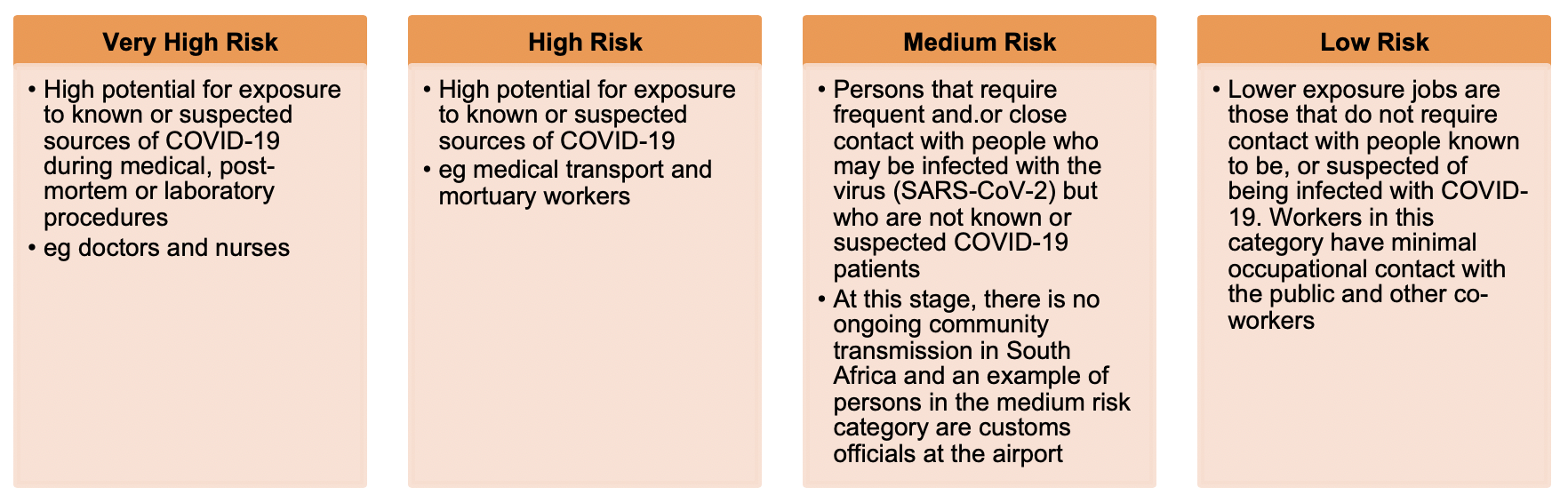

The notice classifies occupations at risk into 4 different categories -

Assessment of permanent impairment will be determined 3 months after initial diagnosis. The degree of impairment will be evaluated based on the complications of COVID-19 on the affected body system(s).

Benefits applicable depend on whether there is temporary or permanent disablement.

The Compensation Fund will only accept applications from persons who fall within the category of confirmed cases.

Government assistance for SMMEs

On 19 March 2020, the Minister of Small Business Development announced two measures to assist SMMEs during this time: the Debt Relief Fund and Business Growth/Resilience Facility.

The Debt Relief Fund is available to qualifying SMMEs to provide relief on existing debts and repayments during the COVID-19 period of disaster. The fund will also assist with acquiring raw materials and covering labour and operational costs. To qualify, SMMEs will need to prove a direct link between your inability to service your business loan and COVID-19.

There will be a centralised registration system - www.smmesa.gov.za - where SMMEs will apply and be screened. This system will go live on 24 March 2020.

The Business Growth or Resilience Facility will also be available for SMMEs. This facility will enable SMMEs to continue to participate in supply value-chains particularly those who locally manufacture or supply various products that are currently in demand due to Covid-19 pandemic. The facility will offer working capital, stock, bridging finance, order finance and equipment finance to qualifying SMMEs.

Recap on general leave options

We have previously provided guidelines on general leave options for employees during this time.

We recap those guidelines below.

Employees infected with COVID-19

The employer should apply its sick leave policy to such an employee. The employee must consult a medical practitioner and obtain a medical certificate. Any time out of the office will be considered as sick leave. An employee affected with COVID-19 should not be permitted to return to work until cleared by a medical practitioner.

Employee self-quarantine

Employees may wish to self-quarantine for various reasons, eg due to fear of contracting COVID-19 whilst at work or during their commute to work or simply because the employee wants to be responsible and practice social distancing.

If the employee is able to work from home, the employee will not be required to take leave for the period of quarantine, if such quarantine period is approved by the employer. However, if the employer does not approve the quarantine period or if the employee is not able to work from home, the following options are available -

- annual leave

- unpaid leave

- special paid leave

Employer-imposed precautionary quarantine

If the employee is not sick, sick leave is not applicable. An employer may take precautionary measures to limit exposure of COVID-19 at its workplace by requesting an employee to self-quarantine if the employee -

- travelled to an affected country

- has been or may have been in contact with a person who has or is suspected to have COVID-19

This is an employer-imposed decision and the following options are available -

- special paid leave

- annual leave or unpaid leave (such a decision may be unfair as this is an employer-imposed decision and the employee is able to render services)

Alternatively, if the employee is able to work from home, the employee will not be required to take leave for the period of quarantine.

Fake news

Under the disaster management regulations, it is an offence to disseminate fake news. Employers should communicate this to their employees. For more information on this, click here.

* Please note that this article is not intended to constitute legal advice and it should be used for general information purposes only. Should you require legal advice on your specific circumstances, please contact one of the listed authors.