The fourth draft of the replacement FP regulations is out, presenting the final opportunity to comment on the replacement regulations to be published ahead of the September 2023 deadline for compliance. We look at some of the key proposed changes below.

We previously assessed the third draft of the replacement FP regulations, and their key proposed changes to the current 2015 FP Regulations,

here. We also recently provided an overview of the significant changes that will be introduced to the financial provisioning empowering provisions in NEMA when the National Environmental Management Amendment Act IV (NEMLA IV) becomes law

here.

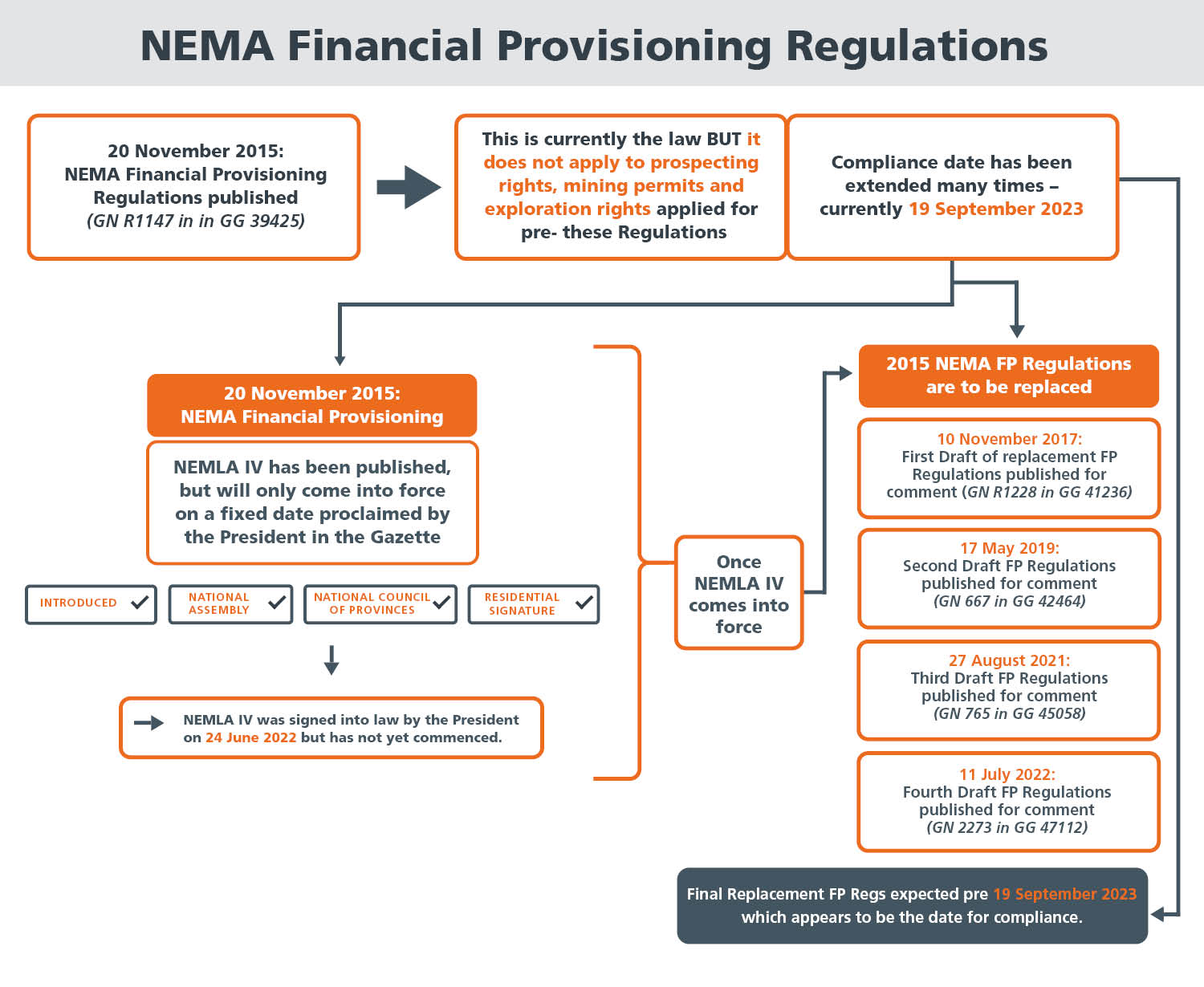

As an overview, the legislative history of NEMLA IV and these financial provisioning regulations is set out below:

Some minor, but significant changes have been proposed to the fourth draft replacement FP regulations since the third draft. These include:

Some minor, but significant changes have been proposed to the fourth draft replacement FP regulations since the third draft. These include:

- The concept of "annual" or "concurrent" rehabilitation is now termed as "progressive" rehabilitation, which the industry already understands.

- At the application stage, Regulation 7 and Regulation 8 Applicants will now only need to provide proof of the arrangements made to secure the financial provision prior to the issuing of the EA, as opposed to providing proof of the financial provision already being available – a practically important change.

- Insurance products will no longer be recognised as permissible financial vehicles themselves, but insurance companies can issue financial guarantees. This is in line with developments in the market allowing companies to fund their financial guarantees with premiums.

- Closure rehabilitation companies and closure rehabilitation trusts may only be established to fund decommissioning, closure and post-closure activities. Ongoing progressive rehabilitation must be funded from operational expenditure (as before). Financial guarantees may still only be used to fund progressive rehabilitation, decommissioning and closure activities, but not post-closure activities.

- External audits are to take place every five years, as opposed to the previously contemplated three-year timeframe.

- Guaranteeing the availability of sufficient funds to bring the area to an

approved sustainable end state at the scheduled or unscheduled closure of operations, determined against approved (previously, this read as "agreed") closure objectives, remains the purpose of the FP Regulations. However, the content requirements for the final rehabilitation, decommissioning and mine closure plan (Appendix 2) now envisage that it should cover the mitigation and rehabilitation activities related to the sustainable end state of the environment

and a post-mining economy at closure and post-closure. This is a significant change, aligning with the Draft National Mine Closure Strategy, 2021, which is currently in its second round of consultation.

- Obligations will be imposed on the mining industry to maintain and retain FP until a closure certificate is granted to a right holder. The definition of "closure certificate" is proposed to be amended to have its issuance subject to the right holder reaching a "risk threshold". The "risk threshold" will be a determination of the environmental risk resulting from an operation, which is regarded as being acceptable after the closure objectives have been implemented and the latent environmental impacts have been calculated and included in the environmental risk assessment report (Appendix 3).

- Responsibility for implementing the requirements of these Regulations and signing off on all documentation submitted to the Minister has been expanded from the CEO to include the holder itself, the CEO, or the board of directors and each director individually of the holder, where relevant.

The public has 45 days, until 25 August 2022, to submit comments.