Government has announced temporary incentives for residential and business solar PV installations to help boost South Africa’s energy generation.

The demand for solar power installations in South Africa is likely to heat up considerably this year after new incentives announced in the February 2023 Budget.

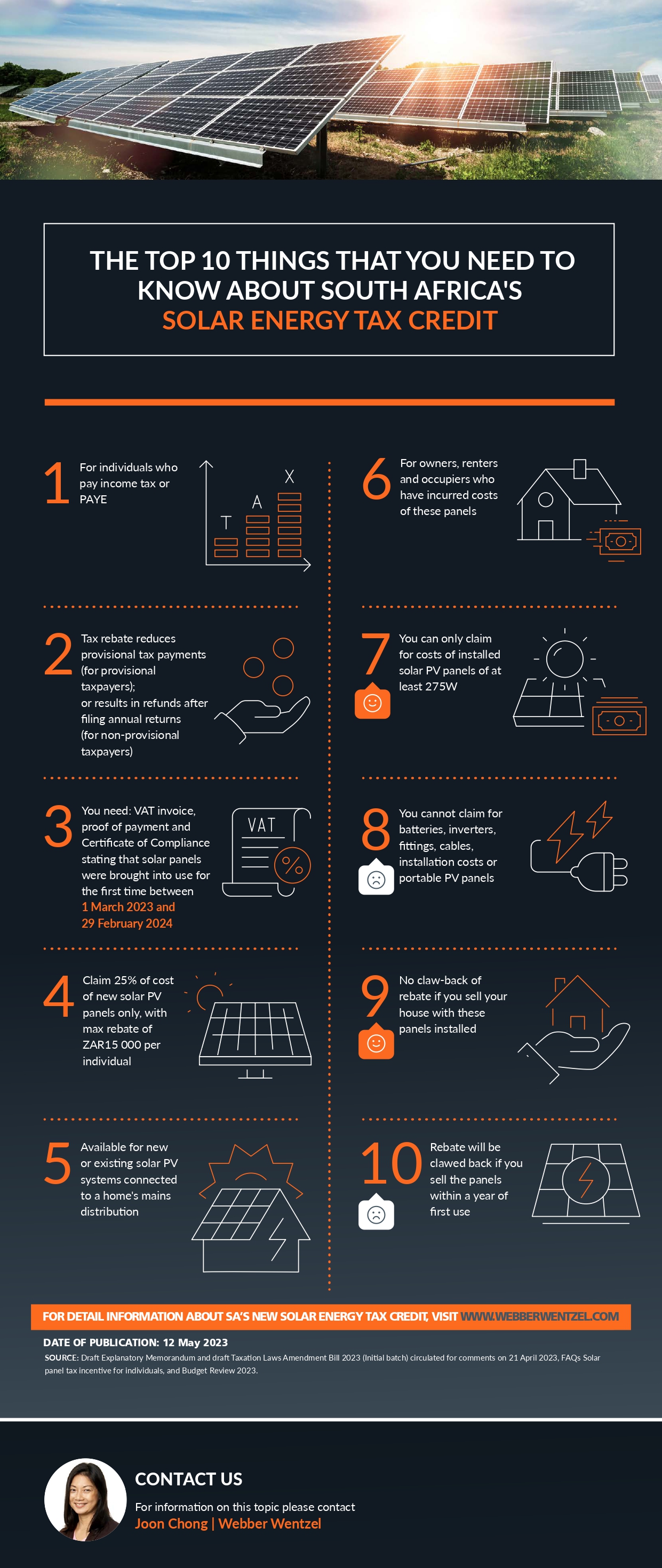

Individuals

Individuals will be eligible for a tax rebate of 25% of the cost of any new and unused solar PV panels that are installed at a private residence and have a certificate of electrical compliance issued between 1 March 2023 and 29 February 2024 in terms of the Electrical Installation Regulations, 2009. The rebate will be known as the "solar energy tax credit" in a new section 6C of the Income Tax Act (Act). Notably, this rebate only applies to solar PV panels with a minimum size of 275W, not other forms of power generation such as inverters, batteries or generators, and the maximum 25% rebate is capped at ZAR15 000 per individual.

The rebate is available to the person who pays for the system, so it is not confined to property owners. The draft EM confirms that the rebate is also available for individuals who rent or occupy residences that are not the owners. These panels may be a new installation, or an extension of an existing system.

The rebate will only be claimable on submission of the ITR12 annual returns for individuals. There is thus a significant time lag between the time expenses are incurred, and when the refund will be received by the individual. As with the home office deductions, we also anticipate stringent verifications by SARS before any tax refunds arising from the rebate is paid to individuals.

To claim the incentive, individuals must present a VAT invoice and proof of payment to SARS, as well as the Certificate of Compliance. A recent draft Third Party Returns of Information notice issued by SARS for comment required persons issuing these certificates to submit third party returns to SARS with, among other things, the tax numbers of the recipients of these certificates.

The draft bill and

Explanatory Memorandum (EM) also invited proposals from body corporates on how the rooftop solar incentive could be applied for installations by body corporates for their members' benefits.

Companies

Section 12B of the Act currently provides an incentive for businesses to install solar PV panels where they were entitled to claim a tax rebate equivalent to 100% of the cost in one year for an installation of up to 1MW, and over three years at 50%/30%/20% for installations above 1MW. Sole proprietors and commission earners using a portion of their homes for business purposes could only claim the portion of the installation used for trade.

The draft EM confirms National Treasury's intention to encourage rapid private investment to enhance the current renewable energy tax incentive in section 12B through a new section 12BA. Section 12BA allows accelerated depreciation at 125% for costs incurred for trade purposes of qualifying assets brought into use for the first time between 1 March 2023 and 28 February 2025.

A solar PV system investment costing ZAR 1 million would qualify for a section 12BA deduction of ZAR 1.25 million. At the current corporate income tax rate of 27%, the investment could reduce income tax liability by R1.25 m * 27% = R337 500. Unlike solar installations for individuals, the section 12BA costs which businesses can claim would not be limited to the costs of the solar PV panels only.

The draft bill confirms that the costs of the foundation or supporting structure brought into use between 1 March 2023 and before 1 March 2025 would also qualify for the incentive, provided the structure is integrated with the solar PV system and deemed to be part of the asset on which it is mounted or fixed, and deemed to have the same useful life as the asset.

The draft bill further provides that the deductible cost to a taxpayer shall be deemed to be the lesser of actual cost; or arm's length cash price of cost of assets, including direct costs of installation or erection of the assets of the renewable energy systems.

Binding private rulings (BPR) are not binding generally, but they provide useful guidance on SARS practice. As section 12BA is a new section, two BPRs on section 12B would be insightful: BPR 311 (11 October 2018) and BPR 172 (25 June 2014). These rulings indicate that section 12B deductions can be claimed for:

- the costs of all PV panels and their constituent parts, including concrete foundations and supporting steel structures;

- DC combiner, DC combiner boxes and feeder lines;

- AC inverters and all equipment, including batteries, used for generation of electricity;

- racking, cables and wiring for the solar PV system (but not distribution boxes not forming part of the system);

- solar PV site installation planning costs;

- solar PV panel delivery costs;

- solar PV system installation costs.

We submit that it is likely that the above costs would also qualify for the enhanced renewable energy tax incentive in the new section 12BA.

The draft bill provides that taxpayers that have claimed the 125% incentive and then sold their solar PV systems before 1 March 2026 will have a potential recoupment of 25% of the purchase price recovered in the sale.

The above solar incentives are most welcomed and will assist with managing the adverse economic effects of load shedding. Comments on the draft EM and bill should be made by 15 May 2023.